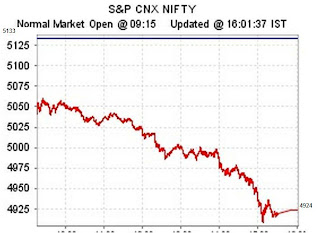

The penultimate session of the september series saw markets trading below the previous close of 4971 after a very strong up move on the day before.

Throughout the series there were varied expectation of Nifty breaking out of 5200 levels as well as correcting much below 4700 levels. But more or less Nifty was confined within that range. Today being the expiry day of September series, the view is that markets can remain in a tight range of 60 points in and around 4946 levels (between 4916 and 4976) levels before closing for the series around 4946 levels.

Options data saw 10 lakhs increase in both 4800 puts and 4900 calls and there were wide spread activity in all out of the money strikes for the series. Throughout the series the implied volatility of calls were very less when compared to that of puts...(calls were being traded around 25 and puts around 37) and this was prompting for an upmove from the bottom level, though the expected breakout on the upperside when Nifty was near to 5150 levels did not happen inspite of the volatility of calls being very low. Similarly the open interest in puts at times were huge when compared to the near strike OTM calls.

It is better to trade in ITM calls and puts for the day, i.e buy 4900 calls when Nifty trades near to the bottom range of 4916 levels and trade in 5000 puts when Nifty trades near to the higher range of 4976...The combined premium of 4900 puts and 5000 calls at end of the day was around 25 and it is not expected that any one of these options will trade higher than the value of 25...If that happens then markets might go for a breakout in that particular direction and might reach 5050 or 4950 levels, though it is currently assumed to be of lesser probability.

Resistance levels : 4976, 5005, 5030

Support levels : 4916, 4896, 4862

The first day of the October series saw nifty testing 5000 levels again after a gap down opening and went on to close at 4943 levels.

The first day of the October series saw nifty testing 5000 levels again after a gap down opening and went on to close at 4943 levels.