Sunday, August 30, 2009

Friday, August 28, 2009

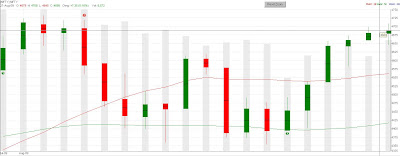

A non-stop bull run to complete the august series. What next?

Resistance levels : 4718, 4735, 4765

Support levels : 4664, 4636, 4605

Happy Trading

www.tripleint.com

Thursday, August 27, 2009

Will the bears gain some control for the expiry ?!

Resistance levels : 4693, 4718, 4735, 4765

Support levels : 4664, 4636, 4605

Wednesday, August 26, 2009

One day to expiry..Where are we heading?

Resistance levels : 4675, 4693, 4718, 4735

Support levels : 4630, 4605, 4586, 4564

Happy Trading

www.tripleint.com

Tuesday, August 25, 2009

Most likely to be a rest day in the expiry week ?!

Resistance levels : 4657, 4693

Support levels : 4605, 4586

Happy Trading

www.tripleint.com

Monday, August 24, 2009

4444 battle won by bulls. Still confined between 20 and 50 DMA

Resistance levels : 4580, 4605, 4630

Support levels : 4507, 4485, 4444

Happy Trading

www.tripleint.com

Friday, August 21, 2009

No change in headlines...4444 yo-yo continuing !!

Resistance levels : 4465, 4490, 4507

Support levels : 4428, 4375, 4350, 4324

Thursday, August 20, 2009

4444 yo-yo continues..Still looks extremely bearish !!

Resistance levels : 4428, 4444, 4480, 4507

Support levels : 4375, 4350, 4324, 4302

Wednesday, August 19, 2009

Nifty back into range, but more of downside seen currently ?!

Resistance levels : 4480, 4507, 4537

Support levels : 4432, 4409, 4359, 4302

Happy Trading

www.tripleint.com

Tuesday, August 18, 2009

Key support of 4444 broken again. Where are we heading ?!

Resistance levels : 4444, 4465, 4485

Support levels : 4359, 4302, 4245

Monday, August 17, 2009

Choppy after a strong upmove. What is the short term trend?!

Resistance levels : 4597, 4630, 4672

Support levels : 4560, 4537, 4507, 4485

Friday, August 14, 2009

A very strong close yesterday. More upside to be seen

Resistance levels : 4630, 4672, 4694

Support levels : 4575, 4544, 4507

www.tripleint.com

Thursday, August 13, 2009

Still confined.. Needs a breakout and close either side..

Resistance levels : 4485, 4511, 4537, 4580

Support levels : 4444, 4415, 4396

Happy Trading

www.tripleint.com

Wednesday, August 12, 2009

Nifty confined between its 20 and 50 DMA...Should wait for a breakout ...

Resistance levels : 4485, 4511, 4537

Support levels : 4444, 4396, 4375

Happy Trading

www.tripleint.com

Tuesday, August 11, 2009

Key support of 4444 broken. Where are we heading ?!

Yesterday the markets could not take advantage of the gap up, but then also went on to make new lows for the series, breaking the 20 DMA support and also breaking and closing below the crucial support level of 4444.

There were a few strong bull traps made around 4507 levels yesterday and market will remain bearish as long as this level and also 4537 is not crossed on the upperside.

Resistance levels : 4444, 4485, 4507

Support levels : 4396, 4375

-

Happy Trading

http://www.tripleint.com/

Monday, August 10, 2009

Retest of 20 DMA. Is the correction over and bull run to continue ?!

Friday, August 7, 2009

More of a healthy correction than a crash...More upside seen next week!

Thursday, August 6, 2009

The more the consolidation..the more the upside !!

Resistance levels : 4718, 4739, 4767, 4816

Support levels : 4664, 4630, 4580

Happy Trading

www.tripleint.com

Wednesday, August 5, 2009

Markets did pause yesterday. Bullish undercurrent seen !!

The undercurrent is still very much bullish and any move above 4718 levels today will start the next round of short squeeze, pushing the markets further to 4767, 4816 levels.

Resistance levels : 4718, 4739, 4767, 4816

Support levels : 4664, 4630, 4580

Happy Trading

www.tripleint.com

Tuesday, August 4, 2009

Picks to watch for 04 Aug

Happy Trading

www.tripleint.com

Markets likely to take pause before the next move ?!

Resistance levels : 4739, 4767, 4816

Support levels : 4680, 4659, 4630

www.tripleint.com

Monday, August 3, 2009

More upside seen in the markets !!

Resistance levels : 4659, 4680, 4705

Support levels : 4605, 4585, 4537

Happy Trading

www.tripleint.com