Thursday, January 27, 2011

Tuesday, January 25, 2011

Monday, January 24, 2011

More bearish than bullish in the expiry week ...

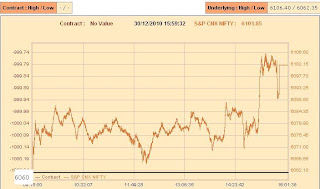

After two weeks of nearly an 8% correction, Nifty consolidated in the last week with a weekly gain of less than 1%. Throughout last week, any strong move in one direction was immediately neutralised by an equally powerful move in the other direction and at the end saw both call and put premium getting completely eroded with implied volatility even dropping to 16%.

On friday again, there was hectic activity in both 5600 puts as well as 5700 and 5800 calls when markets ended on a neutral note around 5700 levels.

Overall market is still under bearish influence and might see a dip below the 200 DMA which is currently at 5614, and there is a good chance of markets breaking 5500 levels before the close of this series in the next three sessions. This view holds good as long as market is not able to test 5765 levels. It is more of a sell on rise market with 5765 as stop on short positions for a target of 5488.

FII have been net sellers of around 3700 crores in index futures and have bought options around 13000 crores for this month.

PCR ratio also dipped below 1 in the last two sessions and is at 0.89 which is also favouring bears to a good extent.

Resistance levels : 5704, 5745, 5762

Support levels : 5639, 5577, 5544, 5488

Monday, January 17, 2011

A consolidation before markets start the down slide again...

Markets broke the 5690 barrier last week and closed at 5655, losing 4.23% over the week. After the initial bounce seen on two sessions, markets were unable to sustain on to the resistance level of 5834 and succumbed to bear pressure closing at levels close to september 2010 from where the strong bull rally started.

Markets broke the 5690 barrier last week and closed at 5655, losing 4.23% over the week. After the initial bounce seen on two sessions, markets were unable to sustain on to the resistance level of 5834 and succumbed to bear pressure closing at levels close to september 2010 from where the strong bull rally started.Options data saw heavy increase in OI in 5600 and 5700 calls and there were increase seen in 5500 puts though not to the extent seen of 20 Lakhs seen in the calls. Overall pattern-wise market is extremely under bears influence and any bounce above 5700 levels would again see sell off. There might be consolidation for some time before bears can again take control and push markets towards 5491 levels even before the close of this series.

Resistance levels : 5690, 5704, 5752

Support levels : 5639, 5577, 5544

Wednesday, January 12, 2011

A bounce near to 5900 levels in the short term even if markets test further lows...

Yesterday markets broke 5700 levels after struggling to move past and sustain above the key resistance level of 5832.

It now looks like markets can hover between the range of 5685 and 5900 levels and any break of 5690 at this stage would again push markets towards 5900 levels triggering short squeeze as was seen towards the end of the session yesterday.

Going forward 5900 level should offer a strong resistance and market is unlikely to move past that and short positions can be initiated near that level. Longs can be initiated on any new low for the series around 5685 levels if markets have not tested 5885 levels before reaching the lows.

Options data saw an increase in OI in all the near strike put and call and is indicating a range move between 5685 and 5900 level for some time.

The key levels remain the same.

Resistance levels : 5791, 5832, 5846

Support levels : 5752, 5721, 5690

Tuesday, January 11, 2011

Markets testing important support level.

Another strong correction ensued yesterday and markets without looking back reached the last support level mentioned for the week of 5752, testing below that and closing just above that.

Any break of this level further on closing basis can push Nifty towards the levels of 5491. It looks like it can consolidate around this level for a while before making the next move.

Options data saw huge increase in OI in near strike calls as well as puts, with more increase seen on the call side.

Going forward 5903 will act as a stiff resistance for this series and below that chances of market slipping further towards 5491 levels seems high.

Resistance levels : 5791, 5832, 5846

Support levels : 5752, 5721, 5690

Monday, January 10, 2011

Weekly Update: Markets to test further lows after a consolidation

Last week bears took complete control and pushed markets to a low breaking 5900 levels momentarily to close the week at 5905, a 3.75% drop over the previous week's close. The magnitude of the fall on friday is quite heavy as Nifty could not get support at 5934 levels and dropped below that.

Overall it is now under bear grip and any bounce towards 5967 levels would attract selling pressure and it is likely that markets would also face a stiff resistance around 6012 levels going forward for this series.

The PCR ratio has dropped below 1 and is at 0.98 which is also starting to favour bears. Last friday options saw hectic activity in all the near strike calls and there has been a significant increase in OI in all the near strike calls of 6000, 6100 and 6200 including that of 5900. 6200 has crossed more than 1 crore mark in OI.

The above points to the fact that the options might have been hugely written on friday and is further favouring bears at this stage. So markets after any consolidation is likely to drop further and test lower levels for the series towards 5750 levels which would offer some support. Any break of 5750 levels would be extremely bearish for the series and might also push markets towards 5500 levels.

As of now, it is a sell as markets near 6000 levels with 6045 being the stop.

Monday, January 3, 2011

Nifty looking strong to begin the new year on a bullish note !!

Wishing all a very Happy and Prosperous New Year 2011 !!!

Wishing all a very Happy and Prosperous New Year 2011 !!!Bulls pushed the markets above 6100 levels during the last week of December 2010 and closed above that level to end the year on a strong note, an 18% gain.

It looks like the bull run is likely to continue in the first week of the new year and markets is likely to reach 6182 level where it can consolidate again for a while before making the next move.

Resistance levels : 6151, 6182, 6234

Support levels : 6120, 6105, 6062

-

Happy Trading

Subscribe to:

Posts (Atom)