Thursday, March 31, 2011

A neutral day to end the March series closer to 5800 levels ?!

The OI increase was seen in 5800 puts as well as 5900 calls. PCR is at 1.11.

Today being the expiry day of the series and the last session of the financial year, it is likely that markets will hover in a range of 5754 to 5832 before settling for a close near to 5800 levels.

Wednesday, March 30, 2011

A correction in the penultimate session for the March series ?!

Yesterday markets saw a rally for the sixth straight session and after reaching a high of 5770 levels, Nifty closed at 5736 levels.

There were increase in OI seen in both 5800 puts and calls and 5700 puts added 20 lakhs in OI.

PCR is neutral at 1.10 levels.

It is likely that market will correct towards 5667 levels in this session breaking the 200 DMA on the downside before staging another rally for the expiry session tomorrow.

Resistance levels : 5743, 5763, 5803

Support levels : 5725, 5703, 5667

Tuesday, March 29, 2011

Entered the expiry week with bulls taking complete control

Nifty is continuing the bullish streak which started on 22nd March and after breaking the key level of 5558 with a powerful gap up opening on friday, bulls completely took control and were able to push markets towards the 200 DMA levels of 5691 after testing above 5700 levels for the first time in two months.

There are 3 more trading sessions for the close of the financial year as well as the expiry of this series and it looks like there could be a close near to 5750 levels for the series.

Inspite of Nifty being in premium, bulls have managed to push markets to higher levels from the low of 5233 for the series.

The expectation in the next three sessions is that market may not dip below 5622 levels and might be hovering in a close range for the next two sessions, before bulls take charge again for expiry and push it towards 5750 levels.

Resistance levels : 5703, 5725, 5743

Support levels : 5667, 5639, 5622

Saturday, March 26, 2011

Saturday, March 19, 2011

Saturday, March 12, 2011

Saturday, March 5, 2011

Friday, March 4, 2011

Tuesday, March 1, 2011

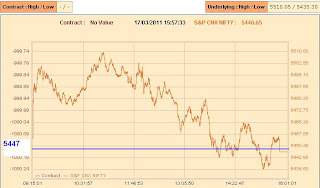

A gravestone doji pattern on the budget day. Will that turn into bullish reversal ?!

The budget day session saw heightened volatility yesterday and finally Nifty closed the day near to the open around 5333 levels after testing 5477 levels.

It has formed a gravestone doji pattern in charts and after the bearish move for expiry on 24th feb and a small consolidation yesterday, there is a chance that Nifty can start a mild bullish rally in the month of march. A close above 5406 levels at this stage would confirm the bullish move and can push it to test the 200 DMA around 5645 levels.

Resistance levels : 5380, 5406, 5432

Support levels : 5304, 5273, 5243

Subscribe to:

Posts (Atom)