Thursday, December 30, 2010

Bears to push markets near 6000 levels in the later half of the session on expiry day

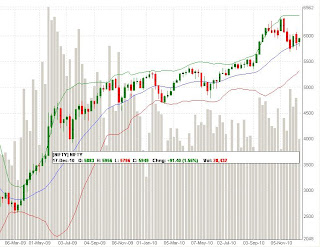

Markets after hovering in a tight range, gave a strong up move in the penultimate session of the december series and closed at 6060 levels after nearly testing the series high of 6069 levels.

Option data saw very huge increase in open interest in 6000 puts and also huge unwinding in 6000 call to the tune of 19 lakhs and 15 lakhs and this is giving a notion that market might not test lower levels of 6000 for the series and possibly could reach higher levels.

Looking at the overall series, there were quite a few indications of range bound moves with Nifty hovering in the levels of 5950 to 6035 levels and it is likely for markets to fall back into range in the day of expiry and go for a close very near to 6000 levels, even breaking that level momentarily in the later half of trade before settling near 6005 levels.

Resistance levels : 6069, 6085

Support levels : 6034, 6005, 5991

Wednesday, December 22, 2010

Markets closed above 6000 mark, but bears to start showing strength.

After markets struggling to hold on to 6000 levels during intraday, finally closed just a shade above that mark after hovering in a tight range throughout the day.

Option data saw huge increase in both 5900 puts and 6100 calls and PCR is neutral at 0.98.

Though there was a bullish move and a close above 6000 levels, bears still are stronger at this juncture and can push Nifty to below 5900 levels in the very near term.

Resistance levels : 6003, 6034, 6057

Support levels : 5985, 5927, 5885

Monday, December 20, 2010

Nifty struggling to set direction for this series...

Yesterday Nifty made a high of 5985, a seven session high, but could not sustain to that level and corrected to close at 5947, inline with the previous close. The levels were mentioned in http://tripleint.blogspot.com/2010/12/pause-before-resuming-upward-journey.html

There has been a consolidation of more than a week around the 20 DMA of 5900 levels. Option data saw an increase of more than 10Lakh in open interest in 5900 puts, but the outstanding is less in that when compared to other strikes. The PCR has dipped to 0.94 which is almost on the neutral side favouring bears mildly at this stage.

Overall markets have not yet established a strong directional move and might remain range bound between 6034 and 5857 for a while.

Resistance levels : 5985, 6003, 6034

Support levels : 5927, 5885, 5857

-Happy Trading

Thursday, December 16, 2010

A pause before resuming upward journey

Yesterday markets corrected nearly 1 percent and closed the day at 5892 breaking the 20 DMA barrier below.

Options saw a good increase in open interest towards the very end of the session in all the near strike out of the money calls of 6000, 6100 and 6200. PCR increased to 1.20 which is favouring bulls to some extent.

Overall market is likely to move up to 6030 levels soon. Tomorrow being a holiday the levels can be reached early next week after one more day of consolidation today.

As of now, it is a buy around 5857 levels with target of 6030 in the very near term.

Resistance levels : 5927, 5947, 5985

Support levels : 5885, 5857, 5834

Wednesday, December 15, 2010

Nifty showing signs of a short term bullish move...

Yesterday was an almost neutral day, but throughout the day bulls were able to make higher highs and higher lows though the magnitude is very less. Nifty also closed above the 20 DMA at 5944 levels.

Options saw mostly intraday action and at end of day there is mild increase in OI in near strike puts as well as in 6000 and 6100 calls. 5900 calls saw unwinding. PCR is neutral at 1.07

Overall it looks like bulls might be able to take markets to test 5985 and even 6030 levels in the short term.

Resistance levels : 5947, 5985, 6030

Support levels : 5927, 5885, 5857

Tuesday, December 14, 2010

Markets returned to levels seen last wednesday...

Yesterday markets returned to the levels of 5900 seen last wednesday and proved to be confined in a range.

Options data saw all near strike puts adding on to open interest and most of the calls unwinding except 6000 call.

There are still not signs of a breakout eitherside inspite of the strong up move seen yesterday (http://tinyurl.com/2cey86g) and it is likely that markets will fall back into range.

Resistance levels : 5921, 5947, 5985

Support levels : 5891, 5845, 5790

Monday, December 13, 2010

Weekly Update: Markets to remain range bound for this week...

Nifty last week after testing 6069 levels lost significantly and closed the week at 5857 levels after gaining more than 1.5% on friday.

Options saw hectic action during last week with 6000 calls adding on to more than 13 lakhs in OI and also unwinding to the tune of 11 lakhs on friday. A huge built up was seen in near strike puts of 5800 and 5700 with calls unwinding. PCR has reduced to 0.92 which is favouring bulls to some extent.

Market is likely to remain range bound with bulls and bears alternating each day for this week also. There might not be a strong breakout either side during this week. A retest of low levels around 5685 would be a buy at this stage.

Resistance levels : 5891, 5947, 5985, 6034

Support levels : 5845, 5790, 5721, 5685

-Happy Trading

Subscribe to:

Posts (Atom)