What the markets did last week ?

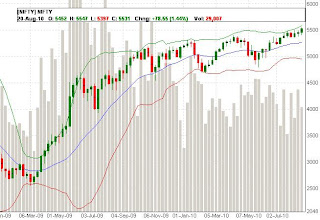

Last week markets were able to reach the weekly target of 5523 levels and also tested the last resistance of 5545 before closing for the week at 5531, a gain of 1.44%. Markets also closed above 5500 mark after a large span of 2 1/2 years

What does the options data indicate ?

Options data towards the end of the week saw huge increase in open interest in the near strike puts and unwinding in all the near strike calls towards the end of the week. The PCR ratio is at 1.33 which is again a bullish sign.

What can be expected this week ?

This week being the expiry week, could see Nifty swaying in a range and bulls still have a very strong upper hand for the expiry and any down move would be nullified by a powerful bullish move going forward. Friday's data indicate an expiry above 5500 levels for this series.

How to trade for the week?

Stay long for the expiry this week on a test of further support levels. A buy on any correction below 5500 levels is recommended.

Weekly resistance levels : 5545, 5565, 5581

Weekly support levels : 5523, 5496, 5447

-Happy Trading

No comments:

Post a Comment